If You Took Early Retirement From the State of Il Can You Go Back and Work for the State Again?

Retirement was in one case a destination — a goal post to marker the end of a long, productive career.

But research indicates that retirement is becoming much more fluid in America.

A 2017 survey from RAND Corporation, a nonprofit research firm, institute that virtually 40 percentage of workers over age 65 had previously retired — just to rejoin the workforce.

And for those still in retirement, roughly half said they would return to paid work if the right opportunity presented itself.

Co-ordinate to researchers: "The fact that these individuals take access to Social Security benefits and possibly other retirement income suggests they tin afford to demand working conditions that more closely match their preferences in order to participate in employment."

And then, what motivates people to "unretire" or start an encore career?

"If you lot're thinking virtually returning to work, one of 2 things has happened," Accredited Fiscal Counselor Susan Greenhalgh told RetireGuide.com. "You've either been struck with a astringent case of boredom and miss the sense of purpose working gives you — or yous're feeling a financial pressure level to go dorsum, maybe due to an emergency."

Financial Considerations of Working After Retirement

Returning to piece of work is a unique, personal decision.

Just earlier you head back, experts similar Greenhalgh say it's essential to get a firm grasp on your current greenbacks flow and budget.

"Y'all need your eyes broad open to your own financial situation," said Greenhalgh, who started her business, Heed Your Coin LLC, in 2018 at the age of 62. "You lot need to be honest with yourself about your needs and your capabilities."

Did You lot Know?

Every bit of February 2019, more xx percent of adults age 65 and older were either working or looking for work, compared with 10 per centum in 1985.

Working in retirement can supplement your income just information technology'southward of import to understand what you'll be gaining — and potentially losing — in the process.

Working afterwards retirement can impact your:

"Information technology's of import to do a deep dive into these things kickoff," Greenhalgh said. "Otherwise, you lot're going to be surprised at how your benefits may exist impacted."

"You need your optics wide open to your own fiscal situation."

If coin is your primary motivator, look for jobs with wages and benefits that make full your income gaps without jeopardizing your benefits or negatively affecting your bottom line.

You tin can return to piece of work and however collect Social Security retirement benefits.

But certain limits and rules must be followed.

Adrienne Ross is a financial planner in Spokane, Washington. She told RetireGuide.com that many people take Social Security benefits at age 62 — fifty-fifty if they have money saved in a retirement account.

"It often seems like a condom, secure idea to take those benefits as soon as possible," said Ross, founder of Articulate Insight Financial Planning.

But starting Social Security when you're get-go eligible reduces your benefits by as much equally 25 to thirty per centum.

"People may merits Social Security at 62 merely to go dorsum to work a few years later because they're not getting equally much money in benefits every bit they predictable," Ross explained.

Your age determines how much y'all can earn.

Social Security Full Retirement Ages

| Year of Nascency | Full Retirement Age |

|---|---|

| 1955 | 66 years and 2 months |

| 1956 | 66 years and iv months |

| 1957 | 66 years and 6 months |

| 1958 | 66 years and 8 months |

| 1959 | 66 years and x month |

| 1960 and afterward | 67 |

In 2022, you can earn upward to $xix,560 without impacting your benefits before full retirement age.

All the same, in one case you striking that threshold, your Social Security check goes down $ane for every $2 earned.

Did You Know?

Social Security does not include other government benefits, investment earnings, interest, pensions, annuities or uppercase gains when calculating your yearly earnings limit.

For example, y'all start collecting Social Security benefits at age 62. At age 64, you get a part-time job and earn $25,000 in a twelvemonth.

This is $5,440 over the limit. Your Social Security check will be reduced by $ii,720 that year — or $i for every $2 earned.

In the year you lot reach your full retirement age, you can earn up to $51,960 in 2022 before your benefits are docked. Subsequently the $51,960 threshold, your benefits are reduced by $1 for every $3 earned.

Finally, once yous hit your full retirement age, there is no cap to your income and you can even increment your Social Security benefits if you cull to continue working. Should your benefits increase, the Social Security Administration volition send you lot a alphabetic character informing you of your new benefit amount.

You will still continue to pay Social Security taxes on your earnings for each additional twelvemonth you work.

Social Security Benefits and Taxes

If Social Security is your just source of income, you don't need to worry near paying taxes on your benefits.

But things get more than complicated if you return to work and showtime making coin.

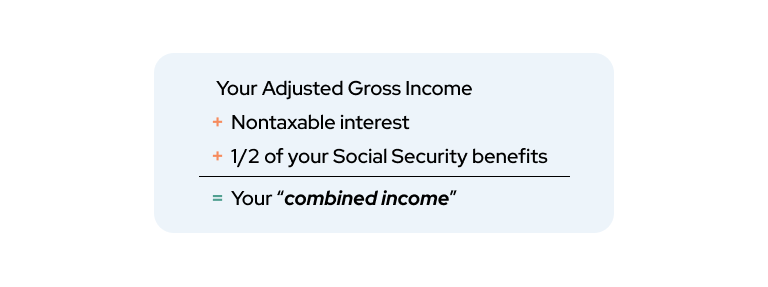

The Social Security Administration uses a term called "combined income" to make up one's mind how much of your bank check tin be taxed.

Combined income is a combination of your:

- Adapted gross income (This is the corporeality you get paid at work — before taxes are taken out — minus adjustments, such as contributions to certain retirement accounts, HSAs and other applicable deductions).

- Nontaxable involvement.

- I-half of your yearly Social Security do good.

If that combined income number is less than $25,000 for an individual, then your Social Security benefits aren't taxable.

If your combined income is between $25,000 and $34,000 for a single filer, you may owe income tax on up to 50 pct of your benefits.

If your combined income is more than than $34,000, upwards to 85 pct of your benefits tin can exist taxed.

Each Jan, you'll receive a Social Security Benefit Statement, Form SSA-1099. Use this when you lot complete your federal return to meet if y'all owe taxes on your benefits.

Tip

Although you're non required to have Social Security withhold federal taxes, it might exist easier than paying quarterly estimated tax payments.

Social Security benefit taxation is complicated. Accomplish out to a tax professional or financial planner if you demand help.

Other Social Security Considerations

Information technology'south smarter financially to delay Social Security benefits until your full retirement historic period, Ross said.

Still, there's a couple means to recoup at least some of those losses.

Showtime, if your benefits were reduced because yous made more than than the income limits mentioned earlier, you actually get that money dorsum — eventually. It isn't gone forever.

Hither'due south how it works.

Let's assume you take Social Security at age 62 and receive a monthly benefit of $1,000. At age 63, yous decide to get dorsum to work.

You piece of work for 12 months and earn more than the $19,560 income limit. Your Social Security benefits are reduced to $500 for 12 months as a result.

Once yous striking full retirement age, those 12 months of reduced benefits are paid back to you.

In this instance, y'all'd receive your normal $ane,000 monthly benefit plus $500 for 12 months.

Later on that, your benefit goes back to your standard $1,000 a month.

Here's something else to proceed in mind: Your Social Security check is based on your top 35 years of earnings.

If your latest year of work turns out to be one of your highest, Social Security volition refigure your monthly do good and you may see a boost in your bank check once you hitting your full retirement historic period.

This is different than recouping your reduced benefits, and it likely won't bear upon you if you lot returned to work for a low-paying or part-time job.

For more information most working and Social Security benefits, check out the SSA's How Work Affects Your Benefits booklet.

Medicare, Private Insurance and Post-Retirement Work

If you're 65 or older, you lot probable get health insurance from Medicare or a Medicare Advantage plan.

Original Medicare is made up of two parts — Part A infirmary insurance and Office B medical coverage. Yous may also choose to purchase a standalone Medicare Part D prescription drug programme or a Medigap supplement insurance policy.

Well-nigh people don't pay a monthly premium for Medicare Part A. Simply about everyone pays a monthly premium for Medicare Role B. In 2022, the Part B premium is $170.10.

If you lot render to work for an employer who offers individual health insurance, yous tin can accept information technology and withal keep your Medicare coverage. You're immune to have both.

Medicare may human activity every bit your primary coverage or your secondary coverage.

Yous may consider dropping Medicare Part B if you return to work. Some people do this to avoid paying the $170.10 monthly premium in improver to whatever employer health care costs.

Nevertheless, this tin can be tricky. If you're non careful, you may owe penalties and confront other problems down the road.

First, your employer must have more than than 20 employees. If that's non the instance, yous may exist penalized for dropping Medicare Part B.

Tip

If you accept applied for or are receiving Social Security benefits, you cannot contribute to an employer health savings account, or HSA. You lot tin can withdraw money already in an account, but y'all tin can't add to it.

If y'all have agile employer coverage, yous can choose to disenroll from Medicare Part B.

In one case yous lose your employer wellness insurance or render to retirement, you must sign upwardly for Part B once more within eight months.

Otherwise, y'all may face a lifetime tardily enrollment penalty.

Meanwhile, you merely get two months to sign upwardly for a standalone Part D plan in one case your workplace coverage ends. Y'all tin confront a late-enrollment punishment for this, too.

To disenroll from Medicare, you'll need to submit a grade, CMS-1763, and it must be completed during an interview with a Social Security representative.

Medicare Coverage for High-Income Earners

Permit's say you render to work subsequently age 65 and proceed your Medicare coverage.

If you country a lucrative second career or consulting position, you may enter a college income subclass and face Medicare surcharges.

That's because, past police, high-income earners pay more for Medicare Part B and Role D.

If you lot're single and earn more than $91,000 just less than or equal to $114,000 a year, you must pay an additional $68.00 a calendar month for your Part B premium in 2022.

For a married couple filing jointly, extra charges start at incomes higher up $182,000.

A like, smaller surcharge applies to Role D premiums.

In 2022, an private who makes between $91,000 and $114,000 a year volition owe a $12.40 income-related monthly adjustment amount in improver to their standard Part D premium.

Pensions and Retirement Accounts

Pensions and retirement accounts are two additional ways people supplement income in later on life.

But certain revenue enhancement rules and weather need to be considered if y'all're rejoining the workforce.

How Returning to Work Can Impact Pensions

Returning to work after retiring may affect your pension.

Each alimony is dissimilar, so it's important to look at your plan's details.

Sometimes, you lot must be rehired equally a part-time or contract worker if you want to work for your former employer and nevertheless receive alimony benefits.

Other times, returning to work for a former employer will suspend your pension benefits.

You can usually notwithstanding collect a alimony and work full-time and then long as it's with a dissimilar company.

Check with your human resources department and your pension plan provider commencement to sympathize any potential penalties.

Retirement Accounts and Required Minimum Distributions

Certain retirement accounts, including 401(g)southward and IRAs, follow a tax rule called required minimum distribution, or RMD.

This requires retirement plan account owners to withdraw coin starting at historic period 72.

Even if you continue working by 72, you must take a RMD from your IRA.

If you don't, you'll face a potential 50 percent tax punishment.

Did You Know?

Roth IRAs practise not have RMDs then long every bit the original owner is even so alive.

You might be able to delay taking RMDs from your current employer-sponsored retirement account, such equally a 401(chiliad) or 403(b).

To delay taking 401(k) RMDs, y'all must:

- Yet be working.

- Have an employer-sponsored retirement account with the business organization you work for.

- Own less than 5 percent of the company y'all work for.

If you lot go back to piece of work, consider calculation coin to your retirement accounts.

A police known as the SECURE Deed of 2019 makes this possible. It allows all retirees to contribute to traditional IRAs and 401(k)s if they earn wages.

People over age 50 tin contribute up to $seven,000 a year to an IRA. And if your visitor offers a 401(k) friction match, accept it. It's substantially complimentary money.

"This can help increase your savings if you perhaps didn't have much money in savings before returning to piece of work," Ross told RetireGuide.com.

Contributing to a retirement account tin can also help kickoff taxes owed on your Social Security benefits because adding money to an IRA or 401(k) programme shrinks your adapted gross income, Ross added.

Finding the Right Post-Retirement Task

Retirement can be a great time to pursue what you lot beloved and make money at the same time.

Due to the pandemic, an increasing number of function-fourth dimension jobs and side hustles can be done remotely at home, making them ideal for seniors.

According to a July 2020 research paper past Harvard University and University of Illinois professors, remote piece of work is most common in industries with better educated and better paid workers.

More than a tertiary of firms that switched employees to remote piece of work said they think information technology will remain more common — even after the COVID-19 pandemic ends.

Online tutoring, freelance content writing and customer service positions are just a few virtual ways older Americans can supplement their income.

And if you're not sure where to outset, or need assist finding a task, organizations like Goodwill Industries have expanded their online services to help people build resumes, polish dress etiquette and find employment at no cost to jobseekers.

Did You lot Know?

During the pandemic, about eleven per centum of people age 65 and older — or roughly i.1 million people — accept lost their jobs.

According to Lauren Lawson-Zilai, senior director of public relations at Goodwill Industries International, 70 percent of locations have transitioned at to the lowest degree some of their career services online.

"The future of work and skills is changing fast," Lawson-Zilai told RetireGuide.com. "If you're but looking in your local classifieds for your side by side task, y'all're missing out on a big number of opportunities."

Enquire an Expert: Tips for Working Later Retirement

Liz Lopez Executive Career and Business concern Autobus

Liz Lopez founded her company, Obsess Your Audience Business Services, 13 years ago in Tampa Bay, Florida. She provides resume pattern, job search strategies, LinkedIn preparation and other services to clients who want to stand out in a competitive, 21st century job market.

ane. Make money past pursuing your passions.

Think near what y'all want to do. What brings you joy in the workplace? Too often professionals brand themselves miserable considering they become subsequently what they think is available rather than what makes them happy.

Late career is a lousy time to be stuck in a job you don't enjoy. Figure out what feels rewarding, then do the research to determine what jobs or businesses align with your goals and skills.

2. Be adaptable and patient.

Embrace how things work now. The task marketplace changes constantly. There is more automation, it'due south a lot less personal and it can move very slowly. Past marketing yourself strategically, you lot can land an opportunity where you make a meaningful impact and exit a valuable legacy.

3. Update your resume — and your Zoom interviewing skills.

Exist prepared to develop a resume, cover letter and LinkedIn profile that aligns with current task market trends. Then learn how to interview effectively via video. Y'all need to powerfully show that you are relevant in today's earth.

iv. Play upwards your recent work history.

Focus on your history and achievements from the terminal x to 15 years. Otherwise, you tin historic period yourself out of consideration if you insist on talking about work you did 30 years ago. Ageism is sadly very real.

v. Consider speaking with a professional.

If you are not sure how to get started, find a career coach experienced with mature and late-career professionals. Whichever road you take, consult with your accountant or taxation professional person to understand the impact of any new income.

Additional Resources

- CareerOneStop

- CareerOneStop is a comprehensive career, training and job search website sponsored past the U.South. Department of Labor. It offers many free online tools, including a job lath, articles, training resources and more. You tin can also detect local aid by inbound your urban center or zip lawmaking into the American Job Center finder on the website.

- Goodwill Industries

- Local Goodwill employment specialists can provide a alloy of in-person and virtual services, classes and training programs in various fields. They as well offer resume assistance and virtual job fairs. Telephone call 1-800-466-3945 or visit goodwill.org to search for your local Goodwill by aught code.

- Senior Community Service Employment Program

- The Senior Customs Service Employment Program connects low-income, unemployed adults historic period 55 and older with community service work at nonprofit and public facilities, such as schools, hospitals and senior centers. Participants piece of work an boilerplate of 20 hours a week at minimum wage and are provided free training as a bridge to unsubsidized employment. For more information, call 1-877-872-5627, or visit the online Older Worker Programme Finder.

- WorkForce50.com

- Launched in 2007, WorkForce50.com allows mature workers to browse a wide range of job postings and explore companies specifically interested in hiring older employees. The website besides features an extensive library of articles on relevant career topics.

Final Modified: March 2, 2022

25 Cited Research Articles

- Centers for Medicare & Medicaid Services. (2020, Nov 6). 2021 Medicare Parts A & B Premiums and Deductibles. Retrieved from https://www.cms.gov/newsroom/fact-sheets/2021-medicare-parts-b-premiums-and-deductibles

- HBS Working Knowledge. (2020, October fifteen). How Much Will Remote Work Keep After The Pandemic? Retrieved from https://www.forbes.com/sites/hbsworkingknowledge/2020/10/15/how-much-will-remote-work-continue-afterward-the-pandemic/?sh=a1d40e310a97

- Jacobson, One thousand., Feder, J. and Radley, D. (2020, Oct 6). COVID-19's Touch on Older Workers: Employment, Income, and Medicare Spending. Retrieved from https://world wide web.commonwealthfund.org/publications/issue-briefs/2020/october/covid-19-touch on-older-workers-employment-income-medicare

- Internal Revenue Service. (2020, September 23). Retirement Topics — Required Minimum Distributions (RMDs). Retrieved from https://world wide web.irs.gov/retirement-plans/program-participant-employee/retirement-topics-required-minimum-distributions-rmds

- Internal Acquirement Service. (2020, September 19). Retirement Plan and IRA Required Minimum Distributions FAQs. Retrieved from https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-required-minimum-distributions#i

- Bartik, A., Cullen, Z., Glaeser, E., et al. (2020, July 29). What Jobs Are Being Done at Dwelling During the COVID-19 Crisis? Evidence from House-Level Surveys. Retrieved from https://hbswk.hbs.edu/item/what-jobs-are-being-washed-at-dwelling house-during-the-covid-19-crisis-bear witness-from-house-level-surveys

- Rapacon, Southward. (2020, June 18). How Older Adults Can Detect Work-at-Abode Jobs During the Pandemic. Retrieved from https://www.aarp.org/work/chore-search/info-2020/finding-work-from-dwelling-jobs.html

- Internal Revenue Service. (2020, February 18). Publication 969 2019 Wellness Savings Accounts and Other Tax-Favored Wellness Plans. Retrieved from https://www.irs.gov/publications/p969#en_US_2019_publink1000204138

- Social Security Administration. (2020). Fact Canvas: 2021 Changes to Social Security. Retrieved from https://www.ssa.gov/news/press/factsheets/colafacts2021.pdf

- Social Security Administration. (2020). How Work Affects Your Benefits. Retrieved from https://www.ssa.gov/pubs/EN-05-10069.pdf

- Social Security Administration. (2020). Retirement Benefits. Retrieved from https://world wide web.ssa.gov/pubs/EN-05-10035.pdf

- O'Brien, S. (2019, August 12). Dropping Medicare for employer health coverage may trip you lot up. Retrieved from https://www.cnbc.com/2019/08/12/dropping-medicare-for-employer-wellness-coverage-may-trip-you lot-up.html

- United Income. (2019, Apr 27). Older Americans in the Workforce. Retrieved from https://unitedincome.capitalone.com/library/older-americans-in-the-workforce

- Edleson, H. (2019, April 22). More Americans Working Past 65. Retrieved from https://www.aarp.org/work/employers/info-2019/americans-working-past-65.html

- Edleson, H. (2018, September 12). Working Later on Retirement: Beware the Cost. Retrieved from https://www.aarp.org/retirement/planning-for-retirement/info-2018/going-back-to-work-ss.html

- O'Brien, S. (2018, August 13). How office-time piece of work in retirement tin touch Social Security taxes and Medicare costs. Retrieved from https://www.cnbc.com/2018/08/13/role-fourth dimension-work-in-retirement-can-bear upon-social-security-and-medicare.html

- Span, P. (2018, March thirty). Many Americans Endeavour Retirement, And then Alter Their Minds. Retrieved from https://www.nytimes.com/2018/03/30/wellness/unretirement-work-seniors.html

- Maestas, N., Mullen, K., Powell, D., et al. (2017). Working Weather in the United States: Results of the 2015 American Working Conditions Survey. Retrieved from https://www.rand.org/pubs/research_reports/RR2014.html

- Barry, P. (2014, April). Disenrolling from Part B. Retrieved from https://www.aarp.org/wellness/medicare-insurance/info-05-2008/ask_ms__medicare_5.html

- CareerOneStop.org. (n.d.). Older worker. Retrieved from https://www.careeronestop.org/ResourcesFor/OlderWorker/older-worker.aspx

- Centers for Medicare & Medicaid Services. (n.d.). Medicare Decisions for Those Over 65 and Planning to Retire in the Next Six Months. Retrieved from https://www.cms.gov/Outreach-and-Education/Find-Your-Provider-Type/Employers-and-Unions/FS4-Medicare-for-people-over-65-nearing-retirment.pdf

- Medicare.gov. (due north.d.). How Medicare works with other insurance. Retrieved from https://www.medicare.gov/supplements-other-insurance/how-medicare-works-with-other-insurance

- Centers for Medicare & Medicaid Services. (due north.d.). 2022 Medicare Parts A & B Premiums and Deductibles/2022 Medicare Part D Income-Related Monthly Adjustment Amounts. Retrieved from https://www.cms.gov/newsroom/fact-sheets/2022-medicare-parts-b-premiums-and-deductibles2022-medicare-part-d-income-related-monthly-adjustment

- Social Security Administration. (n.d.). Benefit Calculators. Retrieved from https://www.ssa.gov/benefits/calculators/

- Social Security Administration. (n.d.). Income Taxes And Your Social Security Do good. Retrieved from https://www.ssa.gov/benefits/retirement/planner/taxes.html

Source: https://www.retireguide.com/guides/working-after-retirement/

0 Response to "If You Took Early Retirement From the State of Il Can You Go Back and Work for the State Again?"

Publicar un comentario